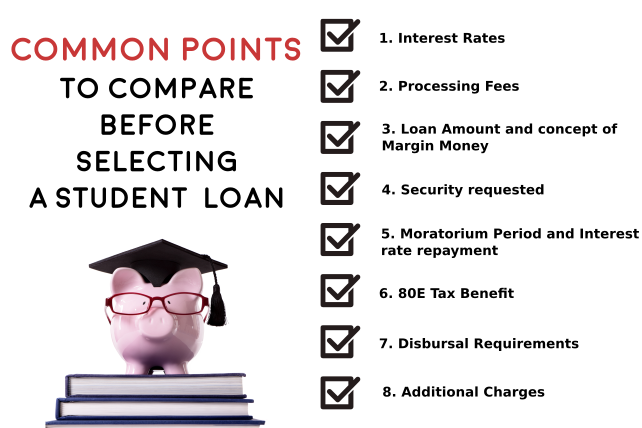

The following are the points of comparison during the education loan

-

Interest Rates – Interest rates are the major financial cost associated while taking a loan. The provisional offer letter would have a current indicative interest rate. The interest rate in India is governed by the MCLR. Banks usually provide a rate of interest based on the cost of borrowing (MCLR) for the bank. NBFC’s would either provide a fixed interest rate or floating rate based on their cost of capital.

-

Processing Fees – Processing fees is the amount requested by the financial institution to process the loan. The same can be refundable, non refundable, amortizable or no processing fees.

-

Loan Amount and concept of Margin Money –

Loan amount is the maximum loan that can be availed for the purpose of the education. Loan amount entitles your maximum draw down capacity across the years of study. The loan amount has to be considered with regard to Margin money. All financial institutions want to ensure that you have the complete amount to fund your education, use the amount only for the purpose of education loan.

-

Complete amount for education: In case the loan is sanctioned with an amount less than the total cost of study involved the bank requires you to show and fund the remaining amount through your own personal funds. This amount is called Margin money that signifies the self-funds required for the loan. With every disbursal you would be required to put in the margin money (as a percentage of loan amount disbursed). In some cases the financial institutions insist that they require a particular amount to be funded by the student through his own funds.

-

Ensuring end use of the funds: Nearly all-financial institutions would like to ensure that the funds are used for the purpose of education. Hence, in this case, they would want the money to be transferred to the university directly. They would also request the student to provide proof of the expenses for food and living expenses, for verification.

-

Security requested (Physical and Non physical)

The sanction would require the security requested by the financial service provider for the availing of the loan. The same could be in the following forms –

-

-

Personal Guarantees – The financial institutions can insist on the personal guarantees of the student and the guarantor. Personal guarantee is a document that signifies the person is liable to pay the loan. The same can be recovered through the court of law, by the bank.

-

Security Mortgage – The security that is pledged by the bank as a security for the loan would be specified as well as the letter would contain the list of documents related to the property that need to be provided to the bank. The same could include an NOC from the society, legal clearances from other family members etc.

-

-

Moratorium Period and Interest rate repayment –

Many financial institutions do not charge interest during the first two years of study. This period when the interest as well as principle is not to be repaid is called the moratorium period. The same would be mentioned in the sanction letter. The financial service provider would specify if you are being granted a partial interest waiver or a full interest waiver. Partial interest waiver is when the financial institutions request you to pay a part of the accrued interest on the loan and adds the remaining interest as the principle outstanding. The complete interest waiver is when the bank does not ask for any amount during the moratorium period. The same is added to the principle outstanding in the loan.

-

80E Tax Benefit

80E tax benefits’ is provided to the applicant in case the service provider is registered as an educational service provider with the RBI. Currently, all banks and only one NBFC have this certificate. With this provision, the amount of the interest paid on the student loan in the same year reduces the taxable income. The same is very helpful and reduces the interest cost for the parent.

-

Disbursal Requirements –

Many financial institutions have special covenants (conditions) during the time of disbursal of the loan. The same generally is mentioned during the provisional or the sanction letter of the bank. The same could be related to property papers, guarantor employment verification etc. Please read the disbursal conditions very carefully to ascertain the availability of all the documents requested.

-

Additional Charges –

There are many charges that skip the eye during finalization of the loan. Please be very careful to understand the type of required mortgage – equitable or complete, insurance policy requested etc. We would request you to add the entire cost of incidental to the interest and then, compare both the loan options.